Obtaining a real estate license is not without training and practice. Depending upon the state in which you live or mean to practice, you will be required to register in a specific quantity of training. Rather than taking a look at this as an expensive endeavor, financiers ought to think about the various ways this education will benefit their investing profession. After all, one of the essential components of being an effective entrepreneur is agreeing to never stop finding out and enhancing yourself. When asking, "is it worth it getting a property license?", think about how the hours of training might enhance your realty know-how, investing lingo, and entrepreneurial spirit.

There are factors both for and versus the questions. Nevertheless, I would be remiss if I didn't a minimum of determine the "failures" of getting your genuine estate license. Remember, there are 2 sides to every coin. While I highly motivate financiers to consider getting their licenses, certain factors necessitate your factor to consider. There is an argument to be made for not getting your license, or at least holding off. Nonetheless, ending up being a certified realty representative doesn't necessarily accompany downfalls, but rather challenges at the point of entry. Below you will discover a number of the reasons people might not wish to get their property license: Becoming a licensed genuine estate representative does not come totally free; you must invest a fantastic deal of time, energy, and even money to practice routinely.

What's more, you will be expected to continue your education to keep up to date with the most recent changes in the industry. Some brokerages will require you to purchase an annual subscription with the National Association of Realtors (NAR) and even insure yourself. While having a realty license can certainly help your investing career, it is very important to acquaint yourself with in advance costs and time investments. In some states, it can cost as much as $1,500 in a given year simply to get and keep your license. Do not let these expenses catch you off guard. A few of the most typical expenses are MLS fees, lockbox fees, real estate agent designation fees, and broker commissions.

While not having your own real estate license will suggest you should count on others, it is totally possible to deal with a talented realty representative that brings your business to the next level (What can you do with a real estate license). What's more, not having to fret about the requireds of ending up being a representative will enable you to focus on what actually matters: income-producing investing activities. For what it's worth, getting your realty license as a financier has considerable benefits. Knowing how to become an investor involves familiarizing yourself with what is required to end up being a certified representative. The coursework and accreditation processes will vary by state, a barrier to entry that can frighten many financiers from making a great choice.

This opportunity could expand your education, network, reliability, and more. By Extra resources assessing these benefits and drawbacks, investors can make an informed decision on whether getting a property license deserves it. Whether you're brand new to investing or have closed a couple of deals, our new online genuine estate class will cover everything you need to know to assist you get begun with real estate investing. Professional investor Than Merrill describes the finest realty techniques to assist get you on the path towards a much better financial future.

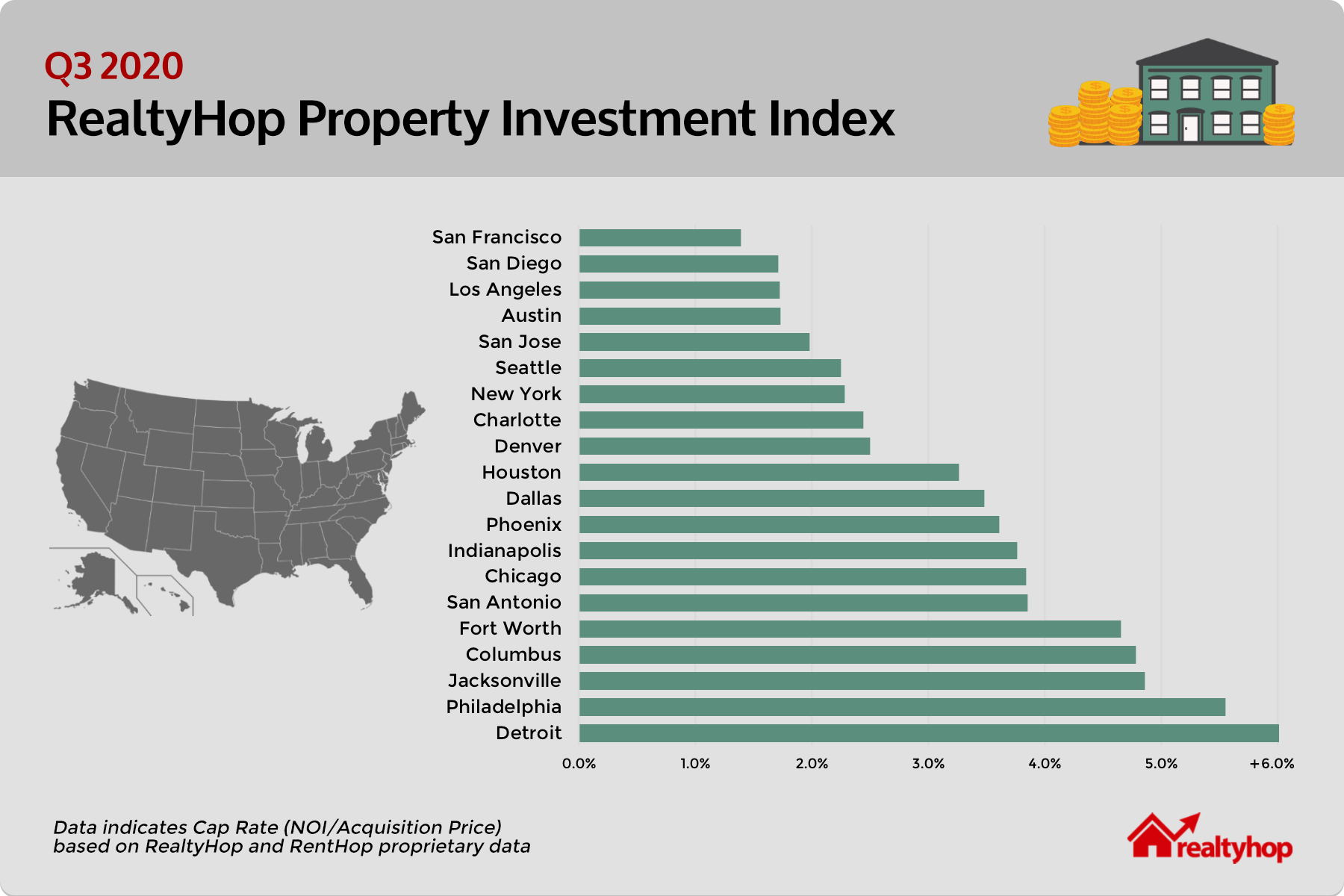

Effective financiers tend to purchase and offer multiple properties in a brief period of timeand deal with the very same representative to do someaning this might be a constant stream of earnings for you. Wish to become their go-to agent? Think about these 7 ideas. Investors go over things like ROI, cap rates, 1031 exchanges, cash-on-cash returns, and net present worth. (If you need to work on your continuing education to speak the very same language, take an appearance at a few of the offered CE courses.) Comprehend what matters to them. They do not most likely care about the existing paint or carpet colors. They only care if the walls need to be repainted, if the restroom requires to be upgraded, and most significantly, how much will it cost - What do real estate brokers do.

The Buzz on How To Start A Real Estate Development Company

You require to understand your customer's financial investment method: Buy, repair, and turn? Purchase wholesale and offer to another investor? Buy, rehab, and lease?: Find out how to make 5% more for each listing with this. What's their financial investment http://holdenjkyv162.raidersfanteamshop.com/what-is-a-real-estate-agent-salary-the-facts horizon? Is this a long-term hold with a 5- to ten-year profit window, or does the investor need to offer the residential or commercial property before buying another one? The more you learn about your investor's timeline, the more beneficial you can be. Find out how to use the lots of computations available to examine and pick property financial investment properties. The relationship between investor customer and agent will be reinforced if you can find ideal homes and assist evaluate their return on financial investment.

What communities are hot right now? What areas are up-and-coming? Where are the best schools? Where are the new tasks found? Help identify those opportunities and present properties for your financier to consider. As soon as you know their objectives and can assist recognize appropriate residential or commercial properties, look for additional ways to add worth to your services. One way to do this is by comprehending their discomfort points and suggesting resources (What are the requirements to be a real estate appraiser). Do they need a great handyman? Price quotes from painters? Floor covering quotes? A tax advisor? Be their go-to source for these recommendations. Signing up with an investor group in your area is a great way to find potential customers, discover what investors in your area are looking for, and give your insight on possible properties.

To end up being a genuine estate financier, there is a number of actions you need to take. The first one, you have actually got to get yourself informed. Now, there are all sorts of live education occasions that are fantastic location to receive some wonderful education, and there are lots of books out there including the book I composed called the. You've truly got to make the the numbers. What does it indicate to crunch them? What does it suggest to find a good offer? What does it indicate to evaluate the deal? Therefore, make it a point to either go to a live occasion or get a copy of Helpful resources a couple of realty books and as you read those, it's going to get you informed.

The 2nd thing. Now, the most bare bones fundamental team would consist of a property manager, a loan officer and a realtor, now not just any of those. You're gon na wish to look, for example initially, for a real estate agent that specializes just on investment residential or commercial properties, fine? They require to reveal you a long track record in history which they have a performance history of finding truly good deals and to show that they've got really great offers. The second thing you need as a financier is a. It's one thing to certify for one home; it's another thing to qualify for lots of houses.