You may be able to buy in even more affordable if you have the ability to find an appealing distressed property through a foreclosure - how to become a real estate agent in texas. You'll typically need to set up a large deposit to start, frequently as much as 30 percent of the purchase cost. So that might be expensive if you're simply starting out and don't have a big bankroll yet. Numerous aspects, consisting of financial investment automobile, holding vehicle, work income amongst other aspects are taken into account. It's not tough to see how taxation can become extremely complex really rapidly. However when succeeded, some realty investments can use significant tax cost savings. If you require help navigating your alternatives, you should consult with your financial consultant.

Returns earned from property financial investments will normally fall under two categories:. Normally speaking, earnings made from realty is subject to an earnings tax and appreciation goes through a capital gains tax. Several of both the active and passive investments that we have actually discussed are capable of earning earnings.

Tax of that income depends upon several factors, however in basic, earnings earned through a rental property is taxable annually and subject to normal income tax rates. As an active investor, the homeowner can likely claim deductible expenditures incurred throughout the year in keeping and repairing the residential or commercial property, such as real estate tax, insurance, and upkeep expenses, therefore minimizing the overall quantity of gross income (how much does it cost to get a real estate license).

Many passive investments can likewise make earnings, generally in the form of passive income, and this income can be distributed in several ways depending on the structure of the investment. Investors who hold property financial investments through stock ownership, such as mutual funds or REITs, can get earnings payments through dividends, which are dispersed according to the variety of shares owned.

Collaborations also enable partners to declare deductions for costs and losses in proportion to ownership and role within the collaboration, but tax implications differ by collaboration. Due to the fact that passive real estate financial investments aren't owned straight by the financier in many cases, the structure of the financial investment can have substantial tax implications for financiers.

How To Be A Real Estate Broker Can Be Fun For Everyone

Likewise, income distributed to REIT and mutual fund investors is taxable only at the investor level and not the fund level as long those funds satisfy the legal requirements to get approved for their chosen structure. Shared funds and REITs can bring an added benefit: Since 2018, financiers who get income distributions from pass-through entities, such as mutual funds and REITs, can access up to a 20% reduction on qualified service earnings each year.

Appreciation is recognized when an investor sells an equity investment whether it's an active or passive financial investment. Upon the sale of that financial investment, any returns earned from appreciation are considered capital gains, and subject to a capital gains tax (what do real estate agents do). The duration of ownership impacts the tax rate of an equity financial investment.

Short-term capital gains are thought about part of your annual earnings and are taxed at common tax rates. If you buy and offer an active financial investment, such as a rental residential or commercial property, within one year, your incomes will be considered short-term capital gains. Similarly for passive investments, if you buy and offer shares of a REIT or exit a collaboration within one year, any gratitude will likewise be subject to short-term capital gains taxes.

Like short-term gains, the adjusted earnings will be taxable, but likely at a lower rate. Taxpayers at or below the 12% limited income tax bracket will typically pay no long-lasting capital gains tax. Those in the 22% - 35% income tax brackets will typically pay 15%, and those in the 37% earnings tax bracket will typically pay 20% capital gains tax.

Capital gains taxes might be delayed or minimized depending upon numerous factors, including the investment automobile through which they were earned and Go to the website how the capital gains are utilized after they are understood. For example, rolling over capital gains into a $11031 Exchange can defer tax liability if one investment residential or commercial property is swapped for another comparable one, but it can't decrease or indefinitely remove your tax liability.

The 9-Second Trick For How To Get A Real Estate License In Texas

Realty investing uses the potential to earn considerable returns and add significant diversification to your portfolio. When handled wisely it can become an important source of capital in your financial investment portfolio in addition to the long-term appreciation potential that it provides. Similar to any financial investment, real estate investments require you to understand and weigh the risks and potential benefits prior to starting.

If it fits with your objectives, readily available resources, and character, hectic, high-risk house flipping endeavors may be what makes the a lot of sense for you. If you don't have substantial understanding and experience for that, or if you don't have a strong desire to end up being a landlord, you can still access the diversification advantages and earning potential of realty.

Fundrise not only provides access to property in the private market, but likewise diversification within the property class. You can invest in portfolios including lots of property possessions varied throughout commercial and house types, debt and equity financial investment structures, in addition to geographically throughout the United States according to your objective.

Benzinga Money is a reader-supported publication. We might make a commission when you click links in this short article. As stock exchange start to fail while property worths remain relatively resilient, realty investing starts to handle a more attractive threat profile to many individuals. If you are wanting to invest even more in realty, keep reading to discover Benzinga's choices for the top 8 best cities to invest in property.

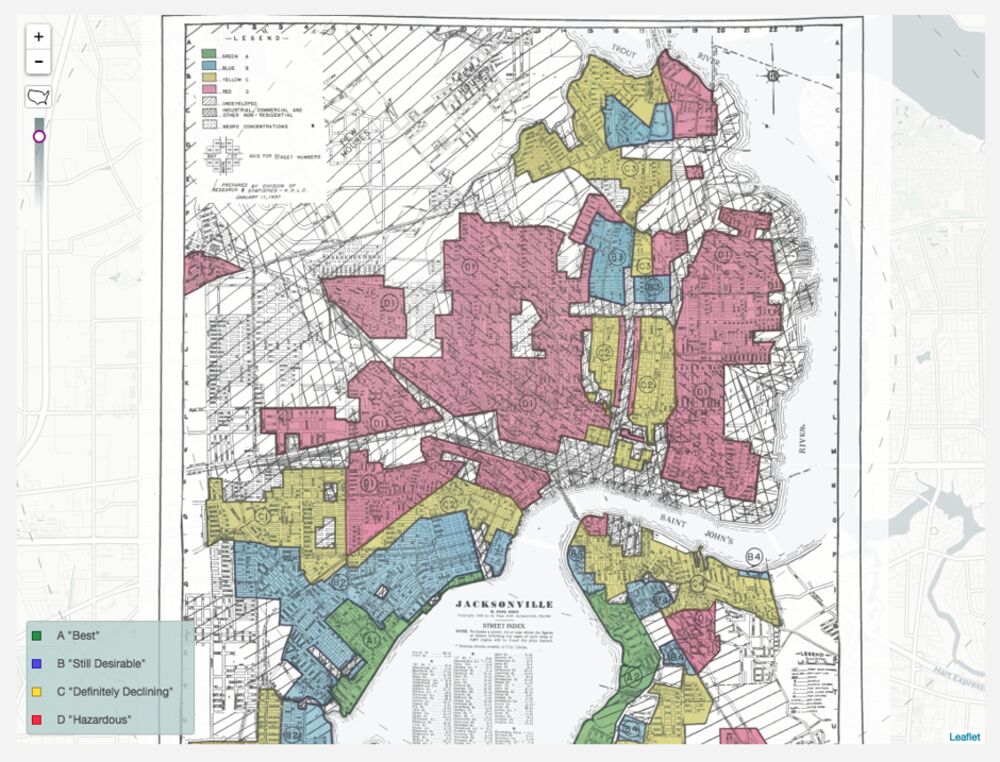

To evaluate a market's prospects, you will desire to get an introduction of the factors that make a city or market ideal for real estate investing, such as:: The market's existing population and predicted development numbers: The existing levels and trends in the typical rent and home rates in the market and Go to this site how budget-friendly they are http://edwinwbzg407.huicopper.com/what-is-the-difference-between-real-estate-agent-and-broker-things-to-know-before-you-get-this offered income levels: Popular local markets and attractive functions that will draw tourism, students and/or irreversible occupants into the market Property investing in the modern age typically involves making use of real estate stocks or investing platforms that streamline the procedure considerably.